When traveling abroad or engaging in international trade, understanding best currency exchange rates in Canada can significantly impact your financial decisions. Currency exchange is the process of converting one currency into another and is crucial for Canadians who wish to enjoy the benefits of global commerce or seek new experiences overseas.

So, what does “best currency exchange rates in Canada” actually mean? In simple terms, it refers to the rates offered by various financial institutions, including banks, credit unions, and specialized currency exchange services, that allow Canadians to convert their Canadian dollars into foreign currencies for the most favorable terms available. This becomes especially important when planning vacations, investing, or purchasing goods from international markets.

Real-life examples illustrate Money Exchange Office in Port Moody the importance of seeking the best rates. Imagine planning a trip to Europe. A delay in exchanging your CAD for Euro due to unfavorable rates could mean losing out on extra cash for souvenirs or activities. On the other hand, using a service that offers competitive rates can enhance your travel experience. Knowing when and where to exchange currency can lead to savings that make a real difference in your journey.

Why Knowing About Currency Exchange Rates Matters

- Budget Management: Understanding exchange rates helps you manage your travel or investment budget effectively.

- Cost Savings: A slight variation in currency exchange rates can lead to significant savings in the long run.

- Opportunistic Timing: Keeping an eye on fluctuating rates allows you to exchange currency when conditions are most favorable.

As Canadians navigate the complexities of international finance, many frequently ask questions about how to obtain the best currency exchange rates. They wonder if banks or currency exchange kiosks offer better rates, or whether online services may provide a more cost-effective solution. Understanding these nuances can empower Canadians to make informed financial choices and maximize their purchasing power globally.

Overcoming Challenges of Best Currency Exchange Rates in Canada

Canada, with its dynamic economy and strong financial institutions, attracts many individuals seeking the best currency exchange rates. However, navigating the exchange rate landscape presents various challenges. First and foremost, the fluctuating nature of exchange rates can be daunting for both individuals and businesses. For example, Julie, a Montreal-based entrepreneur, faced significant losses when she transferred funds to a supplier in Europe. By waiting too long to exchange her currency, she ended up with a less favorable rate. This experience highlights the importance of staying informed about market trends and taking timely action.

Another challenge is the plethora of currency exchange service providers. With banks, online platforms, and local exchange bureaus all offering rates, it can be difficult to determine which one provides the best deal. Many people believe that traditional banks offer the best rates, but in reality, hidden fees can significantly cut into those advantages. Alex, a frequent traveler, discovered this the hard way when he exchanged a large sum at his bank, only to find that a local exchange office provided a better rate without the fees. Understanding these hidden costs is crucial for optimizing currency exchange.

To effectively address these challenges, individuals seeking the best currency exchange rates in Canada should adopt a proactive approach. This includes researching and comparing rates online, setting alerts for favorable exchange rates, and using forward contracts if they anticipate future transactions at current rates. Moreover, leveraging online financial tools and apps can help track the fluctuations and historical trends of the exchange rates. By being equipped with the right knowledge and tools, Canadians can mitigate the challenges associated with currency exchange and maximize their financial outcomes.

Innovative Strategies for Finding the Best Currency Exchange Rates in Canada

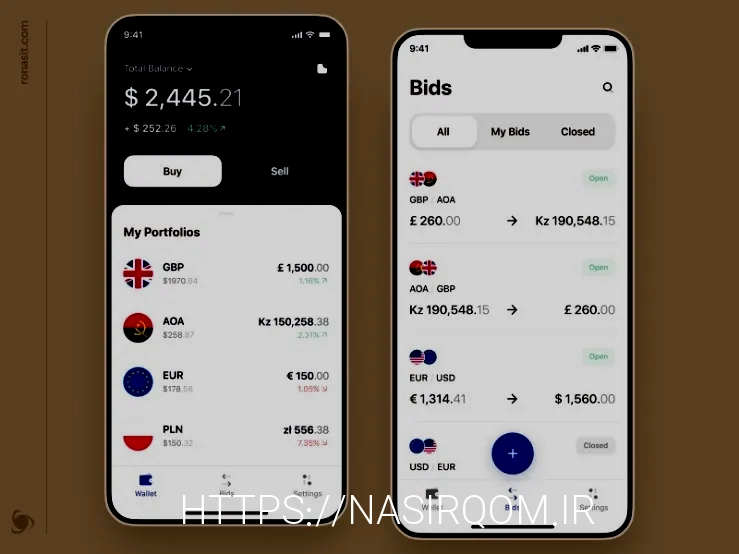

Finding the best currency exchange rates in Canada can feel daunting, especially with fluctuating markets and hidden fees. To tackle this challenge, it’s crucial to embrace innovative strategies that not only enhance your savings but also simplify the currency conversion process. One lesser-known tip is to leverage digital financial platforms and apps that specialize in competitive exchange rates. These tools often provide real-time data and allow users to lock in rates before making a transaction, which can be advantageous if you’re planning a trip or need to make a large purchase in foreign currency.

Another effective solution is to regularly monitor the market trends using online resources and tools. Websites like XE and OANDA provide insights into historic price fluctuations and user-friendly currency converters. By watching these trends closely, you can identify optimal times to exchange your money. For instance, a friend of mine was able to save a substantial amount just by waiting a couple of days for a favorable shift in the exchange rate before converting funds for a vacation in Europe. This simple observation had a significant impact on their travel budget, allowing them to enjoy more activities during their trip.

Moreover, consider consolidating your currency transactions. If you often exchange money for business or travel, bundling your transactions can help you negotiate better rates with service providers. When I regularly needed to convert currency for my business events, I reached out to a currency broker who offered personalized services. By consolidating my transactions, I achieved rates that were significantly better than standard bank offerings. Such brokers often have access to wholesale rates, which can be a game-changer for frequent travelers or business owners dealing with multiple currencies.

Ultimately, staying informed and using available technology is key to navigating the complexities of currency exchange in Canada. Whether through strategic timing, utilizing innovative tools, or forging relationships with brokers, there are numerous pathways to ensure you’re receiving the best currency exchange rates. Armed with these strategies, you can turn the daunting process of currency conversion into a calculated and rewarding experience.

Thoughts on Finding the Best Currency Exchange Rates in Canada

In conclusion, navigating the landscape of the best currency exchange rates in Canada can often feel like a daunting task. However, understanding the nuances of the foreign exchange market and leveraging technology can put you in a favorable position. With numerous online platforms and apps available, consumers no longer have to settle for traditional banks that often provide less competitive rates. Instead, they can compare rates and find reputable exchanges that offer better deals, especially during peak travel seasons or significant economic shifts.

Moreover, as we move toward an increasingly globalized economy, staying informed about market trends and economic indicators can help you make more informed decisions. Ultimately, while the rate you receive is vital, considering fees, service quality, and the overall exchange experience is equally important. Embrace the challenge of finding the best currency exchange rates in Canada as an opportunity for learning and financial empowerment. After all, every percentage point saved can contribute to a more enriching travel experience or a successful investment. So, let your curiosity lead the way, and continue to seek out value in your currency exchanges.

| Challenges of Best Currency Exchange Rates in Canada | Solutions for Best Currency Exchange Rates in Canada |

|---|---|

| Market Volatility | Utilizing automated trading tools to monitor and respond to fluctuations. |

| Hidden Fees and Charges | Choosing transparent currency exchange services with clear fee structures. |

| Limited Currency Pair Options | Using multi-currency accounts that support a wider range of currencies. |

| Exchange Rate Markups | Comparing rates across different providers to find the best deals. |

| Regulatory Changes | Staying informed on policy updates that might affect exchange rates. |

| Access Restrictions | Opting for online platforms that allow for easier access to exchange services. |

| Time Sensitivity | Setting alerts for favorable exchange rates and acting quickly. |

| Currency Conversion Complexity | Using user-friendly currency converters that simplify the conversion process. |

| Economic Factors Impacting Rates | Regularly reviewing economic reports and forecasts to anticipate rate changes. |

| Inconsistent Information | Relying on reputable financial news sources for accurate, updated exchange information. |

Currency